Plateau State is now an Examination Centre for Chartered Institute of Taxation of Nigeria (CITN)

Jos & District Society of the Chattered Institute of Taxation of Nigeria (CITN) has gotten approval from the Council to establish an examination centre the State.

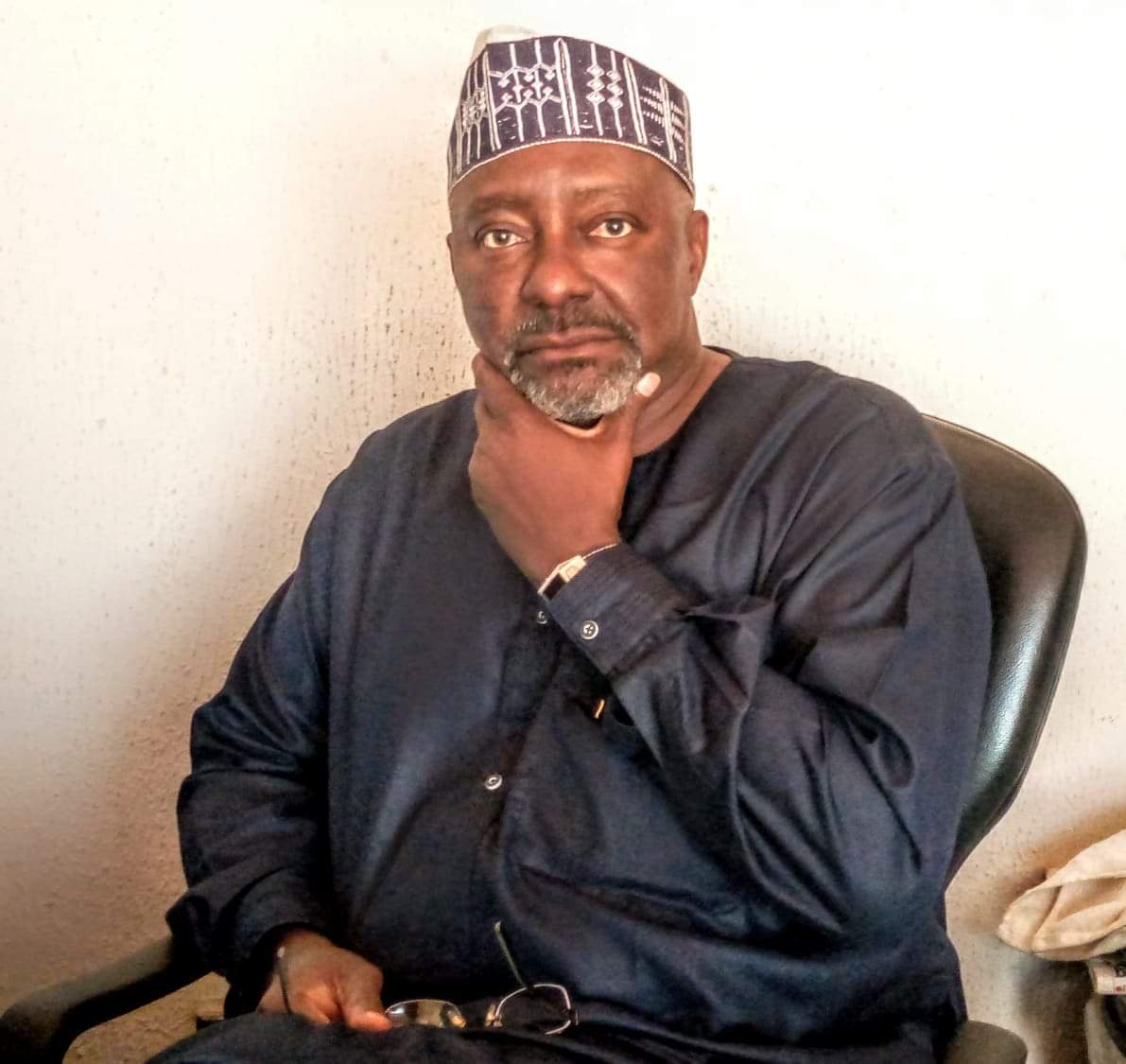

This was disclosed in an exclusive chat with Journalists by the Chairman of the Jos and District Society of the Institute, Mr. Isaac Wadak.

Mr. Wadak said the development is very significant as it will reduce the stress and risk students hitherto go through traveling to Lagos, Port-Harcourt or Kano to write the examination.

“One of our major achievements in Jos District is the recent approval we got from the Institute to establish an examination centre in Plateau State. I think it is significant and a welcome development because before now, people travel to Lagos, Port-Harcourt or Kano to sit for this professional examination. But with this development, the people around here can register and sit for the examination here in Jos.

Mr. Wadak said they have met all the requirements some of which are to have a minimum of 30 Students and a hall for that purpose”

He added that the acquired hall is in Plateau State Polytechnic Jos Campus while about 47 candidates from Federal Inland Revenue Service (FIRS), Plateau State Internal Revenue Service (PSIRS) and Private Students have already registered for the professional examination believing that the number would increase before April.

Mr. Wadak stated that when he came onboard in June, 2019, one of the promises he made was to consolidate on what his predecessor did saying one of the issues his predecessor was working on is that of membership drive which he said was seriously being worked on.

“We have undertaken advocacy visits to other professional bodies that we relate well with like the Institute of Chartered Accountants of Nigeria (ICAN), Association of National Accountants of Nigeria (ANAN), FIRS, PSRIS and the critical Stakeholders (the tax payers). So, you can see that we sit on a tripod; the Tax Administrator, the Practitioners and the Tax Payer while the Institute serves as General Overseer” Wadak stated.

Some other achievements according to Mr. Wadak include, the approval of the Institute for the Society of women in Tax (SWIT) Jos District which he said was just awaiting inauguration; the performance of Tax Practitioners which he said is like a pressure group with the main objective of ensuring professionalism in the practice of taxation based on the provision of the charter of the institute; and the successful conduct of the Mandatory Training Programme last year.

Mr. Isaac Wadak appreciated the cooperation he is getting from his EXCO members and critical stakeholders adding that with that kind of cooperation, the institute would achieve more.

The CITN Chairman said other programme lined up for the year 2020 include the mandatory training programme slated for September, the Zonal Conference which Jos District got the honour and approval to host that of the North Central and the hosting of the Districts meeting around October/November comprising the entire Districts in the country.

The financial Expert also took time to speak on the recently enacted Finance Act saying it remains a welcome development.

He said issues that have to do with taxation also deal with Fiscal Policy and that the expectation was that such policies are reviewed because according to him, as the economic progresses, you expect one form of change or amendment to confirm with the prevailing circumstance.

He further stated that the main focus of the Act is to improve revenue generation of government taking into cognizance that the fortune of oil revenue is depleting which raised the need to substitute it with taxation. He said the Act is to also encourage small and medium businesses.

“At the micro level, government is trying to see how small businesses can also thrive as well as looking at how businesses can be done with ease: So, most of the provisions in the Finance Act are supposed to address these issues”, he said.

Some of the amendments made in the Act according to him were in the areas of company Income Tax 2004, Returns Profit Tax, Value Added Tax (VAT), Customs and Excise Tariff Consolidation Tax, Personal Income Tax and Stamp Duties.

“These are the areas that were affected by the amendment. All these aspects have their laws but were amended to meet the prevailing economic situation.”

Mr. Wadak further posited that taxation is the present and future of Nigeria because according to him, the country can no longer continue to defend on oil anymore adding that thought taxation remains the present and future of Nigeria yet Nigerians are under taxed.

“A careful observation would show you that the ratio of tax to GDP is between 6-8 per cent which is grossly inadequate. So, we are really under taxed in this country,” he said.

Nde Wadak said that the Institute would surely play a vital role towards helping the government achieved its fiscal policy.

count | 281

Recent Comments

Mwanchuel Daniel PamMarch 8, 2024 at 11:06 pm

Bob WayasNovember 6, 2023 at 5:30 am

JosephNovember 5, 2023 at 3:47 am