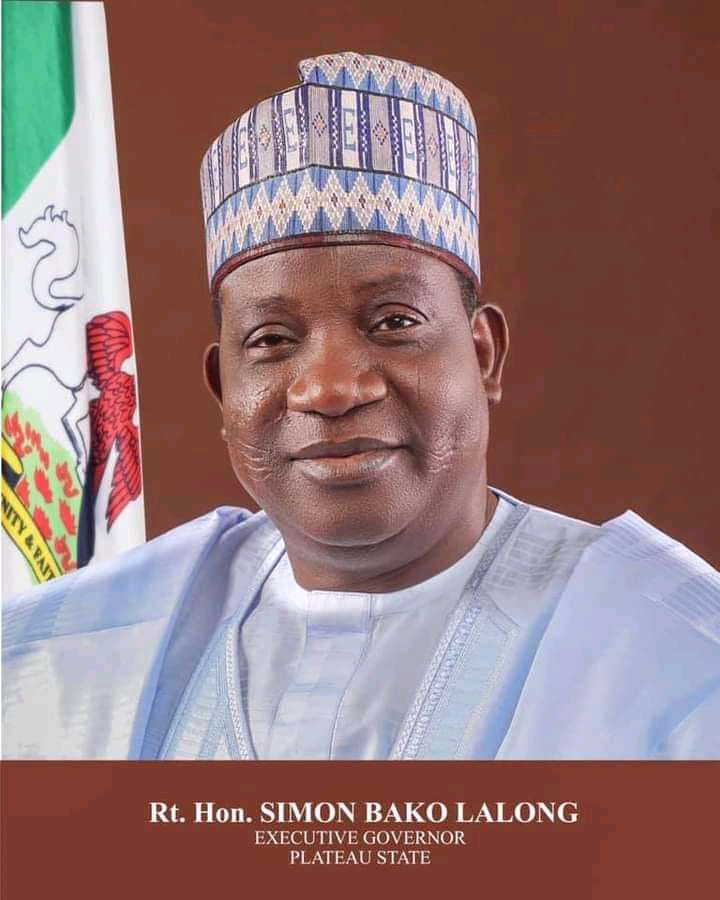

2021 BUDGET SPEECH BY HIS EXCELLENCY, RT. HON. (DR). SIMON BAKO LALONG, KSGG, EXECUTIVE GOVERNOR OF PLATEAU STATE, AT THE PRESENTATION OF THE 2021 APPROPRIATION BILL TO THE PLATEAU STATE HOUSE OF ASSEMBLY ON WEDNESDAY 11TH NOVEMBER 2020.

The RT. Hon. Speaker, Plateau State House of Assembly,

Honourable Members,

Citizens of Plateau State.

“A BUDGET OF ECONOMIC RECOVERY AND CONSOLIDATION OF INCLUSIVE INFRASTRUCTURAL GROWTH”.

- It is again with great pleasure and honour to on behalf of the citizens of Plateau State, present the 2021 Appropriation Bill that outlines estimates of revenue and expenditure of the Plateau State Government in the next fiscal year to this Honourable House.

- Let me begin by once again expressing our deepest appreciation to the Rt. Hon. Speaker, Leadership and entire Honourable Members of the Plateau State House of Assembly for welcoming us into this revered chambers to make this presentation. It is indeed another proof of the mutual and cordial working relationship that exists between the two arms of Government.

- Mr. Speaker, you will recall that the last time I stood before this Honourable House was on November 26th 2019 when I presented the 2020 Budget estimates of the Rescue Administration tagged “Budget of Rescue and Infrastructural Consolidation”.

- Since that was the maiden budget of our second tenure, we outlined the vision and determination to consolidate on the achievements of the first term by improving on our stewardship towards accelerated Socio-Political and Economic Development of our State.

- The rationale behind the budget was to emphasize our Administration’s commitment and resilience to the ideals of continuity in governance, policy and program implementation, as well as sustainability in socio-economic prosperity and infrastructural development of the State.

- This entire budget was to keep faith with the implementation of our Rescue Administration’s Three-Pillar Policy of Peace, Security and Good Governance; Infrastructural Development; and Sustainable Economic Rebirth.

POST MORTEM OF THE 2020 BUDGET - Mr. Speaker, Honourable members, you will also recall that we presented before you at that time a budget estimate for the 2020 fiscal year, to the tune of One Hundred and Seventy Two Billion, Five Hundred and Ninety Six Million, Three Hundred and Seventeen Thousand, Five Hundred and Seventy Seven Naira (₦172,596,317,577.00) only which was prepared under a reasonable degree of consistency both in policy and realism since we came into office in 2015.

- After legislative intervention and scrutiny, this House in its wisdom eventually passed into law an aggregate expenditure of One Hundred and Seventy Seven Billion, Three Hundred and Fourty Million, Five Hundred and Twenty One Thousand, Seven Hundred and Seventy Four Naira (N177,340,521,177.00) only which I signed into law on 23rd December 2019.

- The recurrent component of the budget was Ninety Nine Billion, Three Hundred and Twelve Million, Two Hundred and Seventy Five Thousand, Seven Hundred and Fifty Four Naira (N99,312,275,754.00) only. It also had a capital component of Seventy Eight Billion, Twenty Eight Million, Two Hundred and Forty Six Thousand, Twenty Naira (N78,028,246,020.00) only.

- Barely a quarter into the implementation of the 2020 approved budget, the world was hit by the Corona Virus Pandemic which affected the global economy and sent down devastating consequences to the Nigerian economy and that of Plateau State in particular.

- Consequently, FAAC revenue to the State dropped as a result of not only the drop in price of crude and natural gas but also in daily production. The COVID-19 pandemic also slowed down the already limited inflows to the State, which clearly showed that the implementation of our 2020 appropriation Act was no longer sustainable. This necessitated a downward review.

- Working with this Honourable House, the Judicial Arm of Government and indeed all relevant stakeholders, we were able to put our heads together to come up with a reviewed 2020 budget that reflected the realities of COVID-19.

- This saw the review of the budget from One Hundred and Seventy Seven Billion, Three Hundred and Fourty Million, Five Hundred and Twenty One Thousand, Seven Hundred and Seventy Four Naira (N177,340,521,174.00), to the sum of One Hundred and Twenty Two Billion, Eight Hundred and Forty Eight Million Eight Hundred and Twenty Two Thousand Nine Hundred and Thirteen Naira (N122,848,822,913.00) only (representing (69.3% of the Original Budget).

The revision also factored in N14.8 Billion as COVID-19 response provision. - The revised budget which is currently being implemented consists of N42.8 Billion Naira as capital expenditure and N79.9 billion Naira for recurrent expenditure with a deficit of Twenty seven billion, seven hundred and nine million, four hundred and twenty one naira (N21,709,429,246,00) which is being funded from loans from domestic and external sources.

- I will like to use this opportunity to thank the Legislature as well as the Judiciary for their cooperation that has enabled us to weather through this difficult period of COVID-19 amidst its attendant challenges on service delivery to our people. Although we are yet to get out of the woods, there is hope that we shall soon put this behind us.

- Before I present to you the 2021 Budget, it is appropriate we take a look at the past performance of the 2020 budget and assess the achievements of government in the outgoing Financial Year.

REVENUE MOBILIZATION AND GENERATION 2020 - Since 2015 when we assumed office, we have continued to steadily improve on our revenue generation knowing that it is a critical factor to successful discharge of our mandate to the people as well as in the implementation of budget proposals. Consequently, in our efforts to meet revenue targets most especially the Internally Generated Revenue (IGR), we have worked hard to achieve the new targets that we set for the State Internal Revenue Service.

- This saw us giving final approval for the appointment of a reputable revenue collection firm to work closely with the Plateau Inland Revenue Service for the improvement of our Internally Generated Revenue. Between January to September 2020, we have generated a total sum of Sixteen Billion, Four Hundred and Fourty six million, nine hundred and sixty naira, six hundred and four kobo (N16,446,960,604).

- This is despite the impact of Covid-19 which took a heavy toll on human lives and slowed down business activities in the State. That is why we concentrated on harvesting revenue from sources that were hitherto not enforced. We did not introduce new taxes, but yet were able to generate over N7 billion naira between July and September when the economy started re-opening.

- As a government that is sensitive to the suffering of businesses across the State, we have introduced palliative tax relief measures to help mitigate the adverse effects of the COVID-19 on businesses on the Plateau. These measures include extension of time lines for filing of annual returns; waiver of penalties and interests charged due to late returns; reduction of interest for late payments; as well as granting of one (1) percent bonus to all tax payers who file returns early.

- Other measures taken are the suspension of enforcement of outstanding tax liabilities and reduction of taxes payable by informal sector businesses by up to 50 percent among others. Added to this is the implementation of aggressive tax audit and investigation on all organizations in and outside Plateau State which led to the recovery of over N3.8 billon from Federal MDAs alone.

- Government hopes to build on this trajectory to facilitate the maximization of Internally Generated Revenue accruable to the State. This we hope will make resources available for the delivery of services to our people as well as cope with critical Capital projects as well as recurrent responsibilities such as salaries and other Government running costs. This is crucial even as we have commenced the implementation of the new minimum wage.

- In the spirit of Accountability and Transparency during the year under review (January to September 2020, we have realised a total revenue of Seventy Nine Billion, One Hundred and Fourty Three Million, Twenty Five Thousand Nine Hundred and Fifty Six Naira, Thirty Nine Kobo (N79,143,025,956.39) only. This was realized from the following sources:

a.IGR=============N16,425,710,071.02

b.SRA=============N28,168,222,280.50

c.VAT=============N10,492,876,473.52

d.OTHERS========== N1,083,446,246.87

e.DERIVATION 13%=== N 33,486,281.53

f.EXCESS CRUDE===== N 97,295,619.69

g.DRAWDOWN====== N1,900,000,000.00

h.DONATIONS======= N1,105,077,281.86

i.Bond============= N897,284,036.40

j.Foreign Loan======= N1,701,000,000.00

We have also approved 100% remittance of collections to all Tertiary Institutions in the State to encourage them grow at their own pace.

RECURRENT EXPENDITURE 2020 - Mr. Speaker, Honourable Members, we have continued to ensure the smooth running of Government by ensuring that we build and maintain harmony and tranquillity between Government and Labour by not only paying salaries and wages of workers as and when due, but also ensuring full implementation of staff progression in terms of promotions annual increments and advancements.

- With the support of and understanding of labour, we have commenced the implementation of the minimum wage, effective last month. Payment was initially delayed due to the outbreak of COVID-19 and its attendant impact on the revenue of the State. Needless to say, we ensured that all Civil Servants received their salaries and allowances as and when due even during the lockdown when they were at home.

- The sum of Sixty Six Billion Seven Hundred and Twenty Seven Million, Six Hundred and Forty Nine Thousand, Seven Hundred and Forty Eight Naira Thirty Nine Kobo (N66,727,649,748.39) only has been expended on recurrent expenditure as at September, 2020.

- I am also glad to inform Mr. Speaker and Honourable Members that we have commenced the enrolment of our citizens into the Plateau State Health Insurance Management Agency (PLASCHEMA) to carter for the Medical Health needs of Civil Servants and all citizens in both the formal and informal sectors.

- We have equally continued to invest in the sustenance of the peace and security of our State particularly by ensuring that the recent events that stemmed from the ENDSARS protests were quickly contained and normalcy returned to our State. A significant part of our resources is still being spent on Peace Building Initiatives and Conflict Management.

- During the period under review, the sum of Sixty Six billion, Seven hundred and Twenty Seven million, Six hundred and Fourty nine thousand, Seven hundred and fourty Eight Naira and thirty nine Kobo (N 66,727,649,748.39) only was spent as recurrent expenditure for payment of workers’ wages as well as salaries and Government running cost.

- As we continue to keep our budget deficit as low as possible, I also wish to inform this Honourable House that the State Government has continued to settle its public debt and liability, which currently stands at about Fourteen Billion Three Hundred and Forty Four Million Four Hundred and Forty Four Thousand Seven Hundred Fifty Six Naira Ninety Kobo (N14,344,444,756.90) only and from FAAC deductions only.

CAPITAL EXPENDITURE 2020 - As for capital expenditure, we have expended the Sum of Fourty Two Billion, Eight Hundred and Fifty-Seven Million, Three hundred and fifty-five Thousand Naira, Nine hundred and ninety-eight Kobo (N42,857,355,998.00) till date.

- This amount was spent on critical sectors such as Administration Sector, Economic Sector, Judiciary/Law/Justice Sector, Regional/Geographic Sector as well as the Social Sector. Our emphasis has remained on continuing with both projects inherited from previous administrations and the ones initiated by this administration cutting across road construction, water and energy, hospitals, schools, judicial infrastructure, rural infrastructure, agriculture and tourism facilities among others.

THE 2021 BUDGET ESTIMATES - Mr. Speaker, permit me to once again refresh our minds to the Medium-Term Expenditure Framework (MTEF), and Fiscal Strategy Paper (FSP). As you are aware, the Plateau State Fiscal Responsibility Law 2014, requires that the State Government prepares the Medium-Term Expenditure Framework and Fiscal Strategy Paper which is a planning tool that defines government’s economic, social and development objectives and priorities as enshrined in the State Development Strategy 2019-2023.

- It also details the strategies to achieving government’s defined objectives, and highlights the key assumptions behind revenue projections, strategic objectives behind the expenditure framework, and fiscal targets over the medium term. Furthermore, it articulates the nature and fiscal significance of Government’s debts and measures to reduce such liabilities.

- Accordingly, the Plateau State MTEF and FSP 2020-2022 is in tune with the State Development Strategy 2019-2023, which articulates government’s fiscal situation and agenda in the midst of dwindling oil receipts and slowdown in economic activities resulting in lower tax yields and other internally generated revenues which have been exacerbated by COVID-19.

- Despite the fact that these realities create a widening fiscal gap, especially as we begin the implementation of the new minimum wage, we have to redouble our efforts to ensure that we close the gap through innovation and adoption of strategies that will make us overcome the challenges.

- In line with the Medium-term Economic Policy 2020-2022 requirements, we shall continue to re- position the State economy for local sufficiency, value for money and revenue optimization. Government plans to continue with strategic spending on critical economic sectors especially Agriculture, Solid Mineral Development (Mining) and Tourism.

- This will enable us create opportunities for all segments of the economy and distribute the dividends of increased prosperity fairly across the society such that the indices of human development like unemployment, poverty, inequality will be addressed. We shall continue to build the capacity and fund the Plateau State Microfinance Development Agency (PLASMIDA) and other agencies to ensure that we empower our people.

- Government will utilize its principal fiscal policy tool which is the public budget as well as other associated policies to create the enabling environment that would lead to economic transformation and growth. Using the One-Stop-Investment Centre, Government will focus on attracting Foreign and Domestic, investments, sourcing Local and International Donors Funds, as consummating Public Private Partnerships etc.

- Mr. Speaker, Hon. Members, having laid this foundation, permit me to present to this Honourable House the 2021 Budget Estimates, tagged “Budget of Economic Recovery, Inclusive Growth and Infrastructural Consolidation.”

- The underlying assumptions in terms of macro-economic targets of the 2021 budget are premised on the following:

a. Oil Price of US$ 40 per barrel

b. Oil Production (National) of 1.86 million barrels per day

c. Exchange rate of N378.00 Naira to a dollar

d. Gross Domestics Product (National, Percent Annual Change rate of 3.00)

e. Inflation (National Percent Annual Average of 11.95) - This Budget was prepared under reality of the current economic realities, orchestrated by COVID-19 and with a reasonable degree of consistency both in policy and realism to our vision of achieving the three-pillar policy of peace, security and good governance, infrastructural development and sustainable economic rebirth.

- Having carried out public consultation through town hall meetings and further engagements with relevant stakeholders within the context of the current economic realities, the Government is proposing the total budget estimate of One Hundred and Thirty-three Billion, Four Hundred and Eighty Two Million, Seven Hundred and Five Thousand, Four Hundred and Fifty Seven Naira (₦133,482,705,457.00) only for the 2021 fiscal year. This has embedded in it a COVID-19 component of N11 billion naira only.

- This consists of Eighty three billion, nine hundred and fourty seven million, two hundred and four naira, one hundred and seventy three kobo (N 83,947,204,173.00) only as recurrent expenditure, and Fourty nine billion, Five hundred and thirty five million, five hundred and one thousand, two hundred and eighty four naira (N49,535,501,284.00) only as capital expenditure.

- This indicates an increase of Ten Billion Six Hundred and Thirty Three Million Eight Hundred and Eighty Two Thousand Five Hundred and Forty four Naira (N10,633,882,544.00) only representing 8.6% difference above the 2020 revised budget of One Hundred and Twenty Two point Eight billion naira (N122.8) only. This increase is as a result of increase in both Recurrent and Capital Expenditure estimates.

- Mr. Speaker, Hon. Members, the 2021 estimates presented are intended to pursue programmes and projects with a view to achieving an inclusive and high income strategy, while securing an increasingly better life for all. However, the implementation of these programmes will require significant resources to close a deficit gap of Twenty Two Billion Six Hundred and Sixty Five Million Three Hundred and Fifty Six Thousand One Hundred and Five Naira (N22, 665,356,105.00) only.

RECURRENT EXPENDITURE BREAKDOWN 2021 - The breakdown of this year’s Recurrent Expenditure of Eighty three billion, nine hundred and fourty-seven million, two hundred and four naira, one hundred and seventy three kobo

(N 83,947,204,173.00) only is made up of: - Personnel costs, salaries and pensions: Thirty Seven Billion, Three hundred and fourteen Million, eight hundred and ninety seven thousand Naira, seven hundred and seventy three naira (₦37,314,897,773.00) only. This captures the payment of the new minimum wage and pensions of workers that have left the service recently or will be leaving in the course of the year.

- Overhead Cost: Twenty Seven Billion, Five and Ninety Four Million, One hundred and Sixty Four Thousand Five Hundred Naira (₦27,594,164,500.00) only. The running cost of government has also increased due to demands from our citizens

- Consolidated Revenue Fund Charges: This Sector has an estimate of Seventeen Billion, Thirty Eight Million, One Hundred and Forty One Thousand, Nine Hundred Naira (₦17,038,141,900.00) only.

RECURRENT REVENUE - The Recurrent Revenue in this budget is projected at One hundred and eleven billion, eight hundred and seventeen million, three hundred and fourty nine Naira, three hundred and fifty two kobo (N110, 817,349,352.00) only.

This consists of the following: - Internally Generated Revenue (IGR): Twenty one billion, six hundred and eighty seven million, eight hundred and fifty one thousand, one hundred and three Naira (N21,687,851,103.00) only

2.Statutory Revenue Allocation (SRA) of Thirty nine billion Naira (N39,000,000,000.00) only.

3.Derivation (13% solid Mineral Derivation): Five hundred Million Naira (N500,000,000.00) only. This revenue is accruing to the State for the first and therefore has been projected because of the hope of its continuity or reoccurrence in 2021.

4.Other FAAC Transfers (Exchange Rate Gains, Augmentation etc at Four billion Naira (N4,000,000,000.00) only.

CAPITAL RECIEPTS

5.Value Added Tax (VAT): Seventeen Billion Naira (N17,000,000,000.00) only. There is a great expectation from this revenue with its review from 5% to 7.5% by the Federal Government.

6.Internal Grants: Fifteen billion, seventeen million and eighty-eight thousand, eight hundred and thirty six Naira (N15,017,088,836.00 only

7.External Grants: 0.00

8.Drawdown: Eleven billion, two hundred and ninety-one million, four hundred and nine thousand, four hundred and thirteen Naira (N11,291,409,413.00) only. - Surplus/Excess Crude: Five Hundred Million Naira (N500,000,000.00) only.

CAPITAL EXPENDITURE BREAKDOWN 2021 - Mr. Speaker, Honourable Members, the proposed Capital expenditure in this year’s Budget is Fourty Nine Billion, Five Hundred and thirty five Million, Five Hundred and one Thousand, two Hundred and eighty four Naira (N 49,535,501,284.00) representing 37.12% of the total budget. The sectorial allocation is as follows:

- Administrative Sector: Nine Billion, Eight Hundred and Forty Two Million, Four Hundred and Thirty Nine Thousand Naira (N9,842,457,439.00) Only. This represents 19.87% of the Capital Estimate.

- Economic Sector: This sector has a projection of Twenty Two Billion, Four Hundred and Forty One Million, Eight Hundred and Forty Three Thousand Nine Hundred and Seventy Seven Naira (N22,441,843,977.00) only representing 45.30% of Capital Estimate.

- Law/Justice Sector: Eight Hundred and Seventy Six Million, Six Hundred and Sixty Thousand Naira (N876,660,000.00) only. This figure represents 1.77% of Capital Estimate.

- Social Sector: This Sector has an estimate of Sixteen Billion Three Hundred and Seventy Four Million, Five Hundred and Thirty Nine Thousand Eight Hundred and Sixty Eight Naira (N16,374,539,868.00) only, representing 33.06% of Capital Estimate.

SUB-SECTORIAL ALLOCATION

1.Administration and Finance: The sum of Ten Billion, Fifty Six Million, Ninety Forty Two Thousand Eight Hundred and Three Naira (N10,056,942,803.00) only, representing 20.30% of the Capital budget is allocated to the Administration and Finance Sub-Sectors.

2.Agriculture: In this Fiscal Year, the sum of Three Billion Nine Hundred and Nine Million, Six Hundred and Eighty Two Thousand Nine Hundred and seventy Seven Naira (N3,909,682,977.00) only is estimated for Agricultural Programmes, representing 7.89% of the Capital Budget.3.Commerce and Industries: The Estimate for Commerce/Industries sub-Sector is One Billion Eight Hundred and Two Million, Seventy Six Thousand Three Hundred and Sixty Four Naira (N1,802,076,364.00) only, representing 3.64% of the Capital Budget.

4.Education: The Sum of Six Billion, One Hundred and Twenty One Million, Four Thousand, Seventy Hundred and Forty Naira (N6,121,004,740.00) only, representing 12.36% of the Capital Budget.

5.Environment and Mineral: The Environment and Mineral Sub-Sectors have an allocation of Four Hundred and Fifty Three Million, One Hundred Thousand Naira (453,100,000.00) only. The Estimates of these two Sub-Sectors represent 0.91% of the Capital Budget.

6.Finance: The sum of Four Billion, One Hundred and Thirty Three Million, Eight Hundred Thousand Naira (N4,133,800,000.00) only. This Sub-Sector allocation represents 8.35% of the Capital Budget.

7.Health: The sum of Seven Billion, Twenty Two Million, Five Hundred and Two Thousand Four Hundred Naira (N7,022,502,400.00) only. This Sub-Sector allocation represents 14.18% of the Capital Budget.

8.Information and Communication: The sum of Four Hundred and Four One million, Three Hundred and Sixty Six Thousand Naira (N404,366,000.00) only, representing 0.82% of the Capital Budget is allocated to the Information and Communication Sub-Sectors.

9.Judiciary: The sum of One Billion Twenty Eight Million, six Hundred and Sixty Thousand Naira (N1,028,660,000.00) Only, representing 2.08% of the Capital budget is allocated to the Judicial Sub-Sector.

10.Ministries of Lands, Housing and Urban Development: These Sub-Sectors are allocated Two Billion, Ninety One Million Naira (N2,091,000,000.00) only, representing 4.22% to the Capital Budget.

11.Science and Technology: The Science and technology Sub-Sector has been allocated One Hundred and Sixty Five Million Naira (N160,000,000.00) only and it represents 0.32% of the Capital Budget.

12.Tourism, Culture and Hospitality: The Sum of Three Hundred and Fifty Two Million, Nine Hundred Thousand (N352,900,000.00) only is allocated to these Sub-Sectors and their budget represents 0.71% of the Capital Estimate.

13.Water, Sanitation and Energy: These Sub-Sectors have an allocation of Four Billion, One Hundred Twenty Million, Nine Hundred and Sixty Six Thousand Naira (N4,120,966,000.00) only, representing 8.32% of the Capital Budget.

14.Women, Youth and Sport: The Sum of One Billion, One hundred and Sixty Two Million Naira (N1,162,000,000.00) only, representing 2.35% of the Capital Budget.

15.Works and Transport: The Sum of Six Billion, Seven Hundred and Sixteen Million Five Hundred Naira (N6,716,500,000.00) only, and the total allocation to these Sub-Sectors is 14.82% of the Capital Budget.

SUSTAINING GOOD GOVERNANCE, TRANSPARENCY & ACCOUNTABILITY

- Mr. Speaker, Honourable members, we have in the last five years kept faith with our promise to run a government that is open, transparent and accountable to the people who we serve. Therefore, we shall continue to implement all strategies that will prioritise spending and ensure that our people get value for money in every government transaction.

- We shall ensure that all civil servants discharge their duties with utmost diligence and excellence such that value is added and the benefits are clearly seen by the people. We have therefore put in place more practical avenues to reward excellence and punish indolence. This we believe will motivate the workforce.

- With the appointment of a reputable revenue collection firm, we shall redouble our efforts towards rapidly improving our revenue targets, especially the Internally Generated Revenue which is crucial to funding the 2021 budget.

- Having been recognised by the National Bureau for Statistics as the second least corrupt State in the country, we have continued to strengthen the work of the Treasury Single Account (TSA); the Efficiency Unit; Bureau for Public Procurement; Liquidity Management Committee; as well as the Project Monitoring and Result Delivery Office (PMRDO) to ensure that we maximize our resources and eliminate wastages.

- Only recently, Plateau State was selected to join the Open Government Partnership (OGP), an organization that brings together governments and Civil Society leaders to create more transparent, inclusive, and participatory government.

- As one of the 55 new members selected to join OGP from a pool of 112 applications, our administration is again stressing to the world its determination to advance the open government agenda locally and transform the way the government serves its citizens.

- This comes at a critical moment as we intensify efforts to respond to COVID-19 while also facing strained budgets and climate insecurity and other challenges.

- Against the backdrop of the recent looting, destruction and vandalisation of public and private properties and businesses by hoodlums which led to huge losses estimated at over N75 billion Naira, we are more than ever determined to continue the implementation of our Rescue Agenda.

- Despite this setback and the consequences of COVID-19, we shall continue to engage all stakeholders including our youths as we work to create economic opportunities that lead to self-reliance and job creation.

- As we continue to work towards our planned Economic and Investment Summit, which was delayed because of COVID-19, we shall leverage on the implementation of the 2021 budget if and when passed by this honourable house to improve our investments in productive sectors of the economy to increase our earnings, and provide some empowerment measures for the citizens.

CONCLUSION. - Mr. Speaker and Hon. Members, once again, I am greatly delighted for this opportunity to present to you on behalf of the Plateau People, this “Budget Economic Recovery, Inclusive Growth and Infrastructural Consolidation’’ with the anticipation that you shall give it the necessary attention it deserves.

- While urging the Honourable House to diligently peruse and deliberate on the Budget, I look forward to your cooperation in the speedy passing of the Budget to enable us commence implementation and service delivery from the onset of the New Year.

- This is bearing in mind that timely passage is also going to be a boost for the State to qualify for more grants of the SFTAS Disbursement Link Indicators I and II as well as Additional Financing and Eligibility Criteria (EC I).

- While thanking you for your time, I wish to extend my best wishes to you all and the entire people of Plateau State, and to appreciate all the support that we have been receiving overtime. We look forward the year with a blissful Merry Christmas celebration and prosperous New Year in advance.

- In fulfilment of Provisions of section 121 Sub-Section 1 of the 1999 Constitution of the Federal Republic of Nigeria (as amended) it is now my Honour to seek the permission of the Speaker and the Honourable Members of the House to lay the 2021 “Budget of Economic Recovery, Inclusive Growth And Infrastructural Consolidation’’ for consideration and Passage into Law.

- Thank you and God bless Plateau State.

Rt. Hon. (Dr) Simon Bako Lalong, KSGG

Executive Governor.

11th November, 2020.

count | 138

Recent Comments

Mwanchuel Daniel PamMarch 8, 2024 at 11:06 pm

Bob WayasNovember 6, 2023 at 5:30 am

JosephNovember 5, 2023 at 3:47 am